How we can help

Industries

No matter what vertical you are in, our specialized accountants and advisors can help improve your business. Below are some of our most prominent industries that we frequently work with.

Insights and Updates

Latest News

Paul Reyes, CPA offers insights into key things business leaders

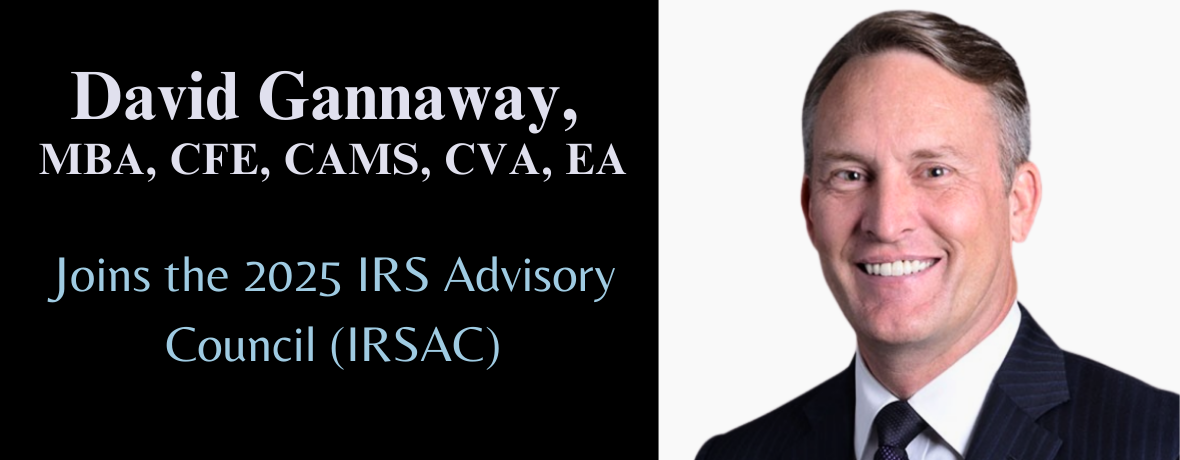

Bederson Principal, David Gannaway, MBA, CFE, CVA, CAMS, EA, NTPI